As we age, the prospect of retirement becomes both an exciting and daunting reality. Many seniors worry about outliving their savings, but with proper planning and financial guidance, it's possible to enjoy a financially secure retirement. Financial experts have a wealth of advice to offer seniors in this situation, and there are several strategies seniors can employ to ensure they don't outlive their savings. Let's explore these strategies in detail.

1. Create a Comprehensive Budget:

The first step in securing for Seniors and their financial future in retirement is to create a detailed budget. Understand a Senior’s monthly expenses, including essentials like housing, healthcare, groceries, and utilities. It's equally important to account for discretionary spending like entertainment and travel. A well-structured budget will Seniors manage their finances effectively.

2. Invest Wisely:

Proper investment is crucial in retirement. A diversified investment portfolio can help manage risk while providing opportunities for growth. Consult a financial advisor to determine the right investment strategy based on your risk tolerance and financial goals. Remember that, while riskier investments may offer higher returns, they can also expose you to greater potential losses.

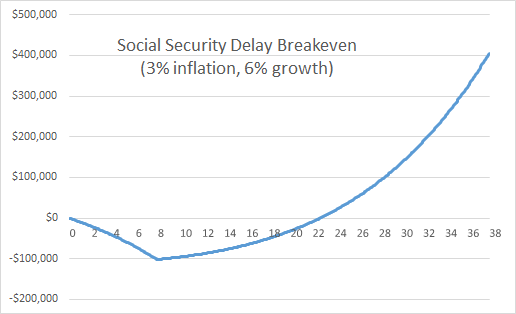

3. Delay Social Security:

Delaying the start of Social Security benefits can significantly increase your monthly payments. While you can begin receiving benefits as early as age 62, your payments will be reduced. Waiting until your full retirement age (usually 66 or 67) or even later can result in substantially higher monthly benefits.

4. Consider Annuities:

Annuities are financial products that provide a guaranteed income stream. Consider using a portion of your savings to purchase an annuity, which can ensure a steady income for life. This provides a safety net for your retirement income.

5. Housing and Expenses:

Housing often represents one of the largest expenses for retirees. Consider downsizing to a smaller, more manageable home or relocating to an area with a lower cost of living. Reducing housing costs can significantly impact your monthly budget.

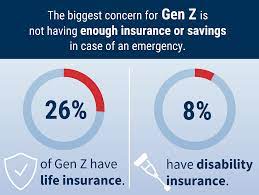

6. Healthcare Planning:

Healthcare costs can be a substantial financial burden in retirement. Make sure you have a comprehensive health insurance plan and consider long-term care insurance to manage these expenses. Understanding the Medicare and Medicaid programs is crucial to navigate the complex healthcare landscape.

7. Manage Debt:

As you approach retirement, focus on paying off high-interest debt and aim to avoid accumulating new debt. Reducing financial obligations will ease the pressure on your retirement savings.

8. Explore Part-Time Work or Side Income:

Many retirees find part-time work or develop side income sources to supplement their savings. This additional income can help cover expenses and reduce reliance on your savings, allowing them to last longer.

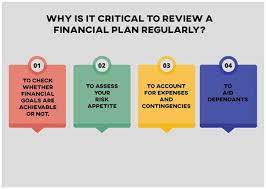

9. Regularly Review Finances:

Your financial situation may change over time. It's essential to review your financial plan regularly and adjust as needed. Life circumstances, tax laws, and investment opportunities can change, so staying informed and being adaptable is crucial.

10. Estate Planning:

Proper estate planning ensures your assets are protected and distributed according to your wishes. Consult an estate planning attorney to set up wills, trusts, and other relevant documents to secure your legacy.

In conclusion, while the fear of outliving savings in retirement is common, there are effective strategies to alleviate this concern. Creating a well-structured budget, investing wisely, and making informed financial decisions are all part of a secure retirement plan. Seek the guidance of financial experts and work closely with them to tailor a strategy that aligns with your individual needs and goals. By taking these steps, you can enjoy your retirement years with financial confidence and peace of mind.

Here is the link to the website of one of our trusted partners in the community. Drazen Rubin Law specializes in traditional elder care, estate planning, tax planning and Life Care Planning services and helps clients in CT.